E-invoicing for issuers of invoices to the federal administration

You can find important information here to help you create and submit electronic invoices to organisations of the direct and indirect federal administration.

What invoice issuers need to know about e-invoicing

What invoice issuers need to know about e-invoicing

A quick overview

- As of 27 November 2020, you must be able to create, submit and securely store electronic invoices (e-invoices) until the required retention period has expired.

- Since that date, federal contracting authorities have no longer accepted invoices in paper form or as PDF files.

- In order to submit electronic invoices, you may have to revise your system for sending out invoices, review internal processes and train staff.

What is an electronic invoice?

Electronic invoicing allows for fully automated transmission and processing of invoice information, from the creation of invoices to their electronic transmission, automated receipt and further processing. An e-invoice presents invoice information in a structured, machine-readable data file, rather than on paper or in other data formats such as a PDF file.

What do I need to know about sending electronic invoices to federal contracting authorities?

What do I need to know about sending electronic invoices to federal contracting authorities?

The XRechnung standard

Technically speaking, an e-invoice is a data set arranged in a standardised structure. In Germany, the XRechnung standard was developed to ensure uniform implementation of e-invoicing. The XRechnung standard is thus Germany’s version of the European standard EN 16931 (a Core Invoice Usage Specification, or CIUS).

The XRechnung standard enables the seamless and secure receipt of invoices and their further automated processing with various software systems. XRechnung is a standard for converting invoice information into an XML data file. The XML data file constitutes an electronic invoice. Electronic invoices for the federal administration must be issued using the current version of the XRechnung standard format in accordance with section 4 (1) sentence 1 of the federal E-Invoicing Ordinance (E-Rechnungsverordnung, ERechV). Other standards may be used (such as ZUGFeRD (version 2.2.0 or later) in the XRechnung profile) as long as they meet the requirements of the European standard (EN 16931), the terms of use for the invoice submission portals, and the requirements of the federal E-Invoicing Ordinance.

Buyer reference (Leitweg-ID)

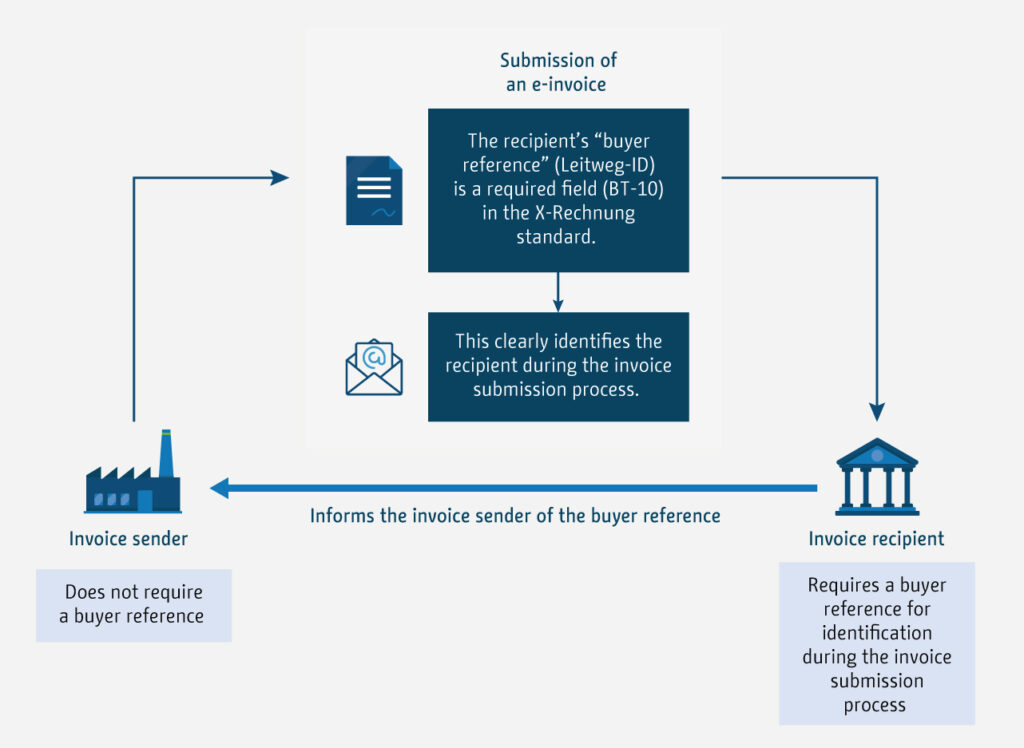

To send an electronic invoice to a public invoice recipient, the recipient must be uniquely identified and addressed using a buyer reference (Leitweg-ID). The buyer reference enables the e-invoice to be addressed electronically and forwarded to the invoice processing systems of the federal administration authorities linked to the central invoice submission portal.

The invoice recipient’s buyer reference is entered in the field “Buyer reference” (BT-10) in the XRechnung standard. The buyer reference must be provided with every e-invoice sent to federal administration authorities. The contracting authority should provide the invoice issuer with its buyer reference; if not, the invoice issuer should ask the contracting authority for it.

Illustration: Transmission of an e-invoice using the buyer reference (Leitweg-ID)

Note!

Please note that invoice issuers do not need a buyer reference of their own.

The Federal Central Invoice Submission Portal

The Federal Central Invoice Submission Portal

At the federal level, the OZG-RE invoice submission portal is available for submitting e-invoices.

Online Access Act-compliant Invoice Submission Portal (OZG-RE)

The direct federal administration as well as a large number of institutions of the indirect federal administration already receive e-invoices via the Federal Online Access Act-compliant Invoice Submission Portal (OZG-RE).

You can register with the OZG-RE test environment to try out the electronic invoice functions before actually sending any invoices to the federal administration.

You can register as an invoice issuer with the OZG-RE production environment to create and submit your invoices.

Please note: In addition to the OZG-RE, organisations of the indirect federal administration may implement their own solutions for receiving electronic invoices. Please check with your invoice recipient.

An overview of the invoice recipients from the direct and indirect federal administration currently connected to the OZG-RE is available here (overview in German only).

Transmission methods

Transmission methods

You can create an e-invoice manually in the OZG-RE, or you can create one outside the federal invoice submission portal, for example using a standard commercial enterprise resource planning (ERP) system. The federal invoice submission portal offers four different ways to send e-invoices.

Before sending an e-invoice to a federal contracting authority, you should choose the transmission method that works best for you. You can find more information in the guide to choosing a transmission method.

Web submission

To create an e-invoice, you can enter the invoice information manually within the federal invoice submission portal and submit the e-invoice from there.

Manual upload

After registering with the federal invoice submission portal, you can upload e-invoices that you have created using an external system and submit them to your invoice recipient.

Peppol

Peppol enables the fully automated exchange of electronic documents. This means that all participants can seamlessly export and import documents from different processing systems. The Peppol network is especially helpful for sending large numbers of e-invoices (mass transmission), but even for smaller transmissions, the Peppol network enables seamless and efficient digital processing.

You can send e-invoices that you have created using an external system via email to the federal invoice submission portal.

Invoice information

According to the federal E-Invoicing Ordinance (document available in German only), an e-invoice must include at least the following information:

- Buyer reference (Leitweg-ID)

- Bank details

- Payment terms

- The email address of the invoice issuer

- Seller identifier*

- Purchase order reference*

*If this information was provided to the invoice issuer when the contract was awarded.

E-invoicing in Germany’s federal states

E-invoicing in Germany’s federal states

The federal E-Invoicing Ordinance governs the sending of e-invoices by suppliers to the federal administration. Germany’s federal states implement EU Directive 2014/55/EU under their own responsibility.

In order to help you send e-invoices to the federal states, we have put together some useful information:

E-invoicing in Germany’s federal statesFurther information for invoice issuers

In the library, you will find extensive information about e-invoicing in the federal administration, videos explaining how to use the Peppol network and video tutorials on using the federal invoice submission portal OZG-RE. If you have any questions, please let us know. Write to us using our contact form.

Weiterführende Informationen

Here you will find information on e‑invoicing in the federal administration.

-

Laws and ordinances

E-invoicing legislation in Germany

-

Documents

Here you can download detailed information about electronic invoicing in the federal administration.

-

Tutorials

Here you will find videos on how to use the OZG-RE invoice submission portal and videos about the Peppol transmission network.